These days, the fashion for NFTs on the Ordinals protocol and fungible BRC-20 tokens is exploding, and together they are boosting Bitcoin mining activity and making the business more profitable.

What does this mean for the Bitcoin network and what are the advantages/disadvantages for the end-user?

Let us analyse the situation in detail.

What are Ordinal NFTs and why could they boost bitcoin mining?

The Taproot update to the Bitcoin protocol, which went live in November 2021, was a complete game-changer for Satoshi Nakamoto‘s network, increasing transaction privacy for users and improving scalability and security.

Progress has been made since this implementation two years ago, thanks in part to the introduction of Ordinals, a protocol that allows NFTs and native tokens to be issued directly on the bitcoin blockchain.

Although these functionalities are generally feasible through the use of smart contracts, as is the case on the Ethereum network, in this case the conditions are very different.

The basic idea behind Ordinals, a protocol devised by Casey Rodarmor, the developer of Bitcoin Core, is to allow data such as images, videos and text to be ‘’inscribed’’ on individual satoshi, making each sat to which this information is added ‘unique’.

In this way, the problem of the lack of smart contracts on the Bitcoin network was overcome, prompting many users to create NFT-style digital artefacts and fungible tokens.

The result was astonishing: millions of pieces of data were transcribed into individual minimum units of BTC (the satoshi), increasing the fees paid to use Bitcoin’s infrastructure and increasing the average block size published on the chain.

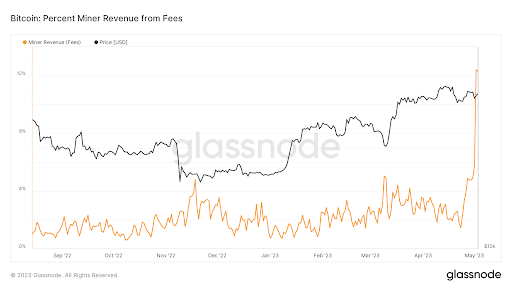

Miners are grateful to Casey Rodarmor, as the percentage of income from transaction fees now represents around 12% of the total income earned by those in this business: this is 8 times more than on 23 April, the day the Ordinals trend broke out.

Let us remember that bitcoin mining earns money in two ways: firstly, from block rewards, which are fixed but vary according to predefined mechanisms such as halving or difficulty adjustment, and secondly, from the fees paid by users to have priority in the execution of transactions and to include additional data on each block generated.

We do not know if the ordinals craze is a passing fad or if the crypto community will continue to modify satoshi by adding data of any kind.

However, if this trend continues, it would create a huge incentive for miners to continue their activities and ensure the security of the network by increasing the overall hashrate of the blockchain.

A look at bitcoin mining revenues: is the advent of NFTs and BRC-20 tokens really a game changer?

Let’s take a closer look at the mining side effects of the advent of Ordinals and the fungible BRC-20 NFTs and tokens that have been created on the Bitcoin blockchain so far.

The increase in average transaction fees has been a fortuitous event for miners, who need support now more than ever, given the threat of new threats from the US.

Tim Frost, CEO of Yield App, said that bitcoin miners could be taxed by the US government because of the energy impact and CO2 emissions generated by the hardware used in the activity.

“Bitcoin miners are facing new threats in the US in the form of a new White House proposal to tax the equivalent of 30% of their energy costs to cover the “damage they inflict on society”.

What’s more, with bitcoin’s next halving expected on 27 April 2024 (or rather at the peak of the 840,000 block), miners will soon be earning half the coins currently mined every 10 minutes or so.

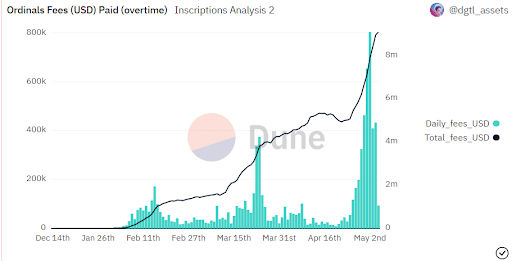

The explosion of the Ordinals trend and the increase in the Fess to enter Satoshi data, which costs around $50 per million bytes added, has been a boon to the mining industry and could greatly increase the earnings of those working in it, if only this craze continues in the coming months.

Consider that since the Ordinals protocol went live, some $9 million in fees have been paid just to create NFTs and BRC-20 tokens, a truly remarkable surplus.

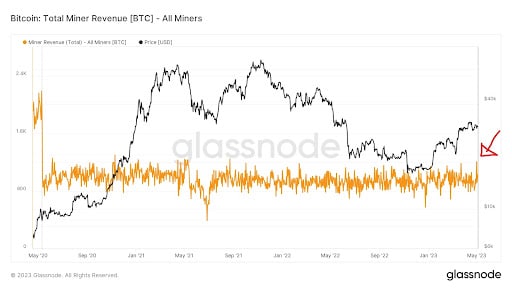

The sheer profitability of the companies in this business has, until recently, depended heavily on the price of bitcoin and the amount of coins issued for each block added to the chain, with transaction fees having little impact on the overall revenue of the miners.

If registrations continue at this pace, and the price of BTC does not drop significantly, we may finally see a reversal in the coming months of a trend that has seen miners’ revenues remain more or less stable, in the range of 600 to 1200 coins per day.

The level to watch to see if the advent of NFTs and BRC-20 tokens on the bitcoin blockchain really is a game changer is the 1200 BTC level: if it is broken, a new era of heavier blocks and richer miners could begin.

Chart of bitcoin miners’ profits in BTC

From a user experience perspective, however, this trend could be viewed negatively: although miners are making money from this situation, users are seeing their transactions costing more and more and sometimes getting stuck in the mempool as the rest of the world competes to pay higher fees and get priority for execution.

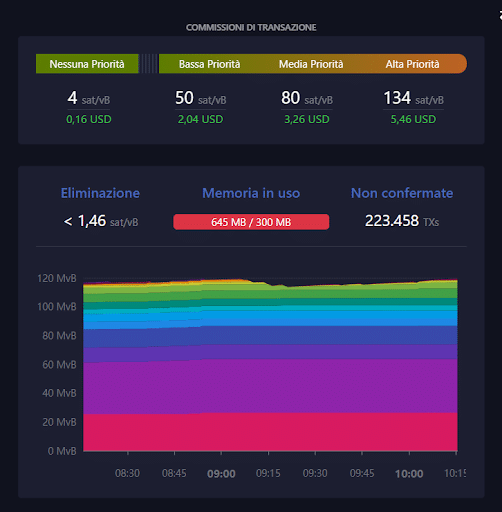

There are currently around 220,000 transactions stuck in the mempool, waiting to be added to a block and executed once and for all.

Who knows if in the future some other digital artefact will manage to solve this problem, using the philosophy of zkrollups and the scalability achievable with off-chain transaction processing.

For now, users are really angry at Ordinals and those who speculate on this trend.

How is the price of bitcoin reacting to the Ordinals trend: buying opportunities?

Bitcoin does not seem to have reacted particularly well to the explosion in the Ordinals NFT trend and the increase in mining profitability.

The cryptocurrency is currently trading at around $29,000 on the chart, with a market cap of $563 billion and volume of $16.7 billion over the last 24 hours.

The bullish price phase started well before the NFT and BRC-20 token craze broke out, in early January 2023, and in recent days we have seen small price gains.

The result is quite obvious when we consider that only one satoshi, or one hundred millionth of a BITcoin, is used for each token, so the markets are not deprived of large quantities of coins.

The positive effects on the price could be seen in the future, thanks to the increase in requests to use the network and, more generally, thanks to the increase in the usefulness of the infrastructure.

Indeed, if the blockchain becomes more like Ethereum, as a “global computer for the world”, bitcoin will certainly start to benefit from the increased functionality that exists.

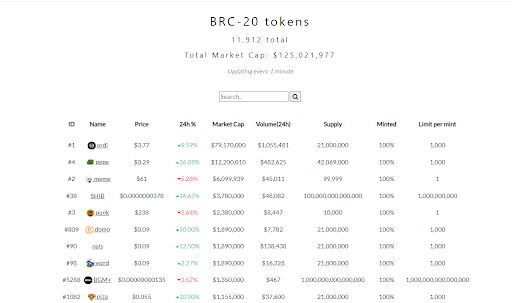

For now, speculative activity is focused elsewhere, mainly on the new BRC-20 fungible tokens, whose market capitalization has exceeded $125 million.

The buying opportunity here could be in this niche market or, in a more traditional financial view, in the shares of listed companies involved in industrial mining.